How Much Home Loan Can I Get on My Salary? Salary vs Loan Eligibility Table

How Much Home Loan Can I Get on My Salary?

Buying a home is one of the biggest financial decisions in life. But before applying for a loan, the most common question people ask is:

How much home loan can I get based on my monthly salary?

Your salary plays a major role in determining your loan eligibility, EMI capacity, and repayment comfort. Banks assess your income, expenses, credit score, job stability, and debt ratio before approving a loan.

In this guide, you will learn:

-

How banks calculate loan eligibility

-

How much EMI you can afford based on salary

-

Full Salary vs Loan Eligibility Table

-

Tips to increase your loan amount

-

Best tools to calculate home loan EMI instantly

home loan eligibility, home loan calculator, salary vs home loan amount, how much loan can I get, EMI calculator, CIBIL score for home loan, home loan interest rate 2025, etc.

1) How Banks Calculate Home Loan Eligibility

Banks follow a basic rule:

Your EMI should not exceed 40% to 50% of your monthly take-home salary.

This is known as the FOIR (Fixed Obligation to Income Ratio).

Example:

If your salary is ₹50,000, your maximum affordable EMI is around ₹20,000 – ₹25,000.

This EMI is then mapped to a loan amount depending on:

| Factor | Impact on Loan |

|---|---|

| Interest Rate | Lower interest = Higher loan eligibility |

| Loan Tenure | Longer tenure = Lower EMI = Higher eligibility |

| Credit Score (CIBIL) | Higher score = Better loan offers |

| Existing Loans | More loans = Lower eligibility |

2) Formula Banks Use to Calculate Home Loan EMI

Many banks use this standard formula:

Where:

P = Loan Amount

R = Monthly Interest Rate (For example, 8.5% yearly ÷ 12 ≈ 0.00708)

N = Loan Tenure in Months (20 years = 240 months)

This formula is automated inside every Home Loan EMI Calculator, which you should place on your website for instant calculations.

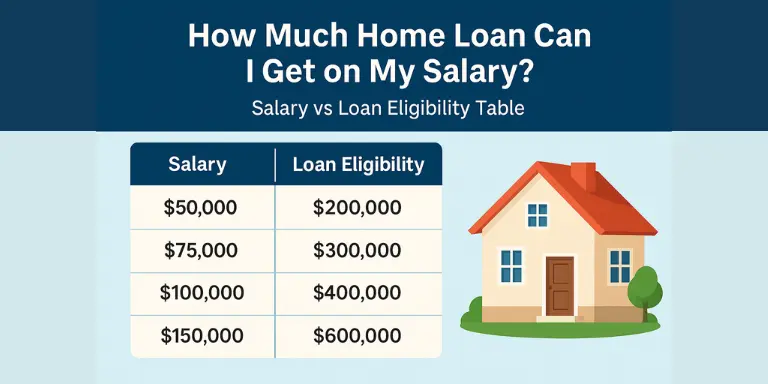

3) Salary vs Home Loan Eligibility Table (2025 Updated)

Assuming:

-

Interest Rate = 8.5%

-

Loan Tenure = 20 years

-

EMI affordability = 50% of Salary

| Monthly Salary | Affordable EMI (Approx) | Approx Loan Amount You Can Get |

|---|---|---|

| ₹20,000 | ₹10,000 | ₹12 – 15 Lakhs |

| ₹25,000 | ₹12,500 | ₹15 – 18 Lakhs |

| ₹30,000 | ₹15,000 | ₹18 – 22 Lakhs |

| ₹35,000 | ₹17,500 | ₹22 – 28 Lakhs |

| ₹40,000 | ₹20,000 | ₹25 – 32 Lakhs |

| ₹50,000 | ₹25,000 | ₹32 – 40 Lakhs |

| ₹60,000 | ₹30,000 | ₹38 – 48 Lakhs |

| ₹75,000 | ₹37,500 | ₹48 – 60 Lakhs |

| ₹1,00,000 | ₹50,000 | ₹65 – 80 Lakhs |

| ₹1,50,000 | ₹75,000 | ₹95 Lakhs – 1.4 Cr |

| ₹2,00,000+ | ₹1,00,000+ | ₹1.5 – 2.5 Cr+ |

Note: Numbers vary based on credit score, tenure, and existing EMIs.

4) Example Calculation

Your Salary: ₹50,000/month

EMI Limit: ~₹25,000

At 8.5% interest for 20 years,

Loan you can get ≈ ₹35 – 40 Lakhs

If you increase tenure to 25–30 years, eligibility increases further.

5) Use Our Home Loan EMI Calculator

Place Your EMI Calculator Here

CTA Example:

Enter Loan Amount → Select Interest Rate → Get EMI in Seconds

6) Factors That Affect Home Loan Eligibility

| Factor | Explanation | Good for Applicant? |

|---|---|---|

| CIBIL Score | 750+ score gives best approval | ✅ Yes |

| Stable Income | Salaried employees with stable job | ✅ Yes |

| Loan Tenure | Longer tenure increases eligibility | ✅ Yes |

| Age | Younger applicants qualify for longer tenures | ✅ Yes |

| Existing Debts | More loans reduce eligibility | ❌ No |

7) Tips to Increase Your Home Loan Amount

-

Improve CIBIL score above 750

-

Pay bills & EMIs on time.

-

-

Add a co-applicant (spouse/parent)

-

Two incomes = higher eligibility.

-

-

Choose a longer tenure (20–30 years)

-

Lower monthly EMI = higher loan.

-

-

Clear existing personal loan or bike/car loan

-

Reduces your debt load.

-

-

Increase your down payment

-

Lower loan needed = easier approval.

-

8) Frequently Asked Questions (SEO Smart FAQs)

Q1: What is the minimum salary required to get a home loan?

Minimum required salary is ₹15,000 – ₹20,000 per month, but it varies by bank.

Q2: Does CIBIL score affect home loan amount?

Yes. Score 750+ offers lower interest rates and higher eligibility.

Q3: Can I get a home loan without salary slip?

Possible only if you show IT returns, bank statements, or business income proof.

Q4: What is the maximum home loan tenure?

Up to 30 years depending on your age and bank policy.

Q5: Can I reduce EMI later?

Yes. You can refinance, reduce interest rate, or increase loan tenure.

Conclusion

Your home loan eligibility mainly depends on your monthly salary, CIBIL score, and existing EMIs. As a rule, banks allow EMIs up to 50% of your take-home salary, which decides how much loan you can comfortably repay.

To calculate your exact loan amount:

Use the EMI Calculator on your website

It gives instant results and helps you plan your home purchase confidently.

Subscribe to our newsletter

Get the latest financial tips and calculator updates delivered straight to your inbox.