Home Loan EMI Calculator with Interest Rate & Tenure – Calculate Your Monthly EMI Easily

- What Is a Home Loan EMI?

- What Is a Home Loan EMI Calculator?

- How Does a Home Loan EMI Calculator Work?

- Why Use a Home Loan EMI Calculator?

- Factors That Affect Your Home Loan EMI

- Home Loan EMI Calculator Example

- Impact of Interest Rate on Home Loan EMI

- Impact of Loan Tenure on EMI

- Fixed vs Floating Interest Rate EMI

- Home Loan EMI Calculator with Prepayment Option

- Frequently Asked Questions (FAQs)

- Conclusion

Buying a home is a major financial milestone, and taking the right home loan is just as important as choosing the right property. Before applying for a loan, it is essential to know how much you will pay every month. This is where a Home Loan EMI Calculator with Interest Rate & Tenure becomes extremely useful.

A home loan EMI calculator helps you calculate your monthly EMI, total interest payable, and overall loan cost based on your chosen loan amount, interest rate, and tenure. This allows you to plan your finances confidently and avoid unnecessary financial pressure.

What Is a Home Loan EMI?

EMI (Equated Monthly Installment) is the fixed monthly amount you pay to the bank or financial institution until your home loan is fully repaid. Each EMI consists of:

-

A portion of the principal amount

-

A portion of the interest

In the initial years, the interest portion is higher, and over time, the principal repayment increases.

What Is a Home Loan EMI Calculator?

A Home Loan EMI Calculator is an online tool that instantly calculates your monthly EMI when you enter:

-

Loan amount

-

Interest rate

-

Loan tenure

It uses a standard EMI formula to give accurate results within seconds.

Popular User Search Keywords:

-

Home loan EMI calculator with tenure

-

Monthly home loan EMI calculator

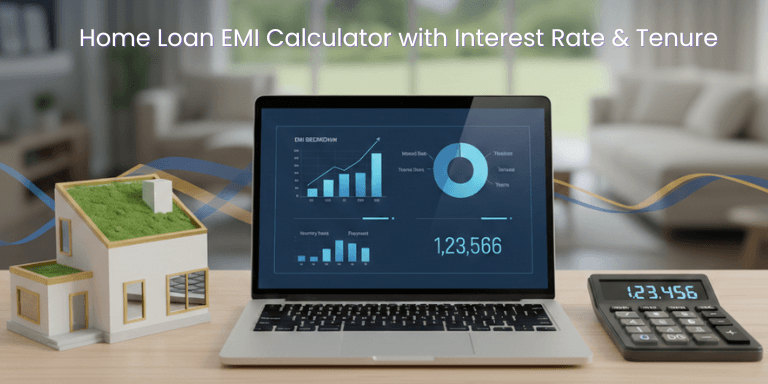

How Does a Home Loan EMI Calculator Work?

The calculator uses this standard formula:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

-

P = Loan amount

-

R = Monthly interest rate (annual rate ÷ 12 ÷ 100)

-

N = Loan tenure in months

You don’t need to calculate this manually—the calculator does it for you instantly.

Why Use a Home Loan EMI Calculator?

Using an EMI calculator before applying for a home loan offers several advantages:

1. Better Financial Planning

Know your monthly commitment in advance and manage your budget effectively.

2. Compare Interest Rates

Easily compare EMIs offered by different banks and lenders.

3. Choose the Right Tenure

Find the perfect balance between EMI amount and loan duration.

4. Avoid Over-Borrowing

Helps you choose a loan amount that matches your income.

5. Free & Instant Results

No registration required and no hidden charges.

Factors That Affect Your Home Loan EMI

1. Loan Amount

Higher loan amount means higher EMI.

2. Interest Rate

Even a small change in interest rate can significantly impact your EMI.

3. Loan Tenure

Longer tenure reduces EMI but increases total interest paid.

Home Loan EMI Calculator Example

Loan Amount: ₹50,00,000

Interest Rate: 8.5% per annum

Tenure: 20 years

Monthly EMI: ₹43,391 (approx.)

Total Interest Payable: ₹54+ lakhs

Total Amount Payable: ₹1.04 crore (approx.)

This clearly shows how interest rate and tenure affect your EMI.

Impact of Interest Rate on Home Loan EMI

| Interest Rate | Monthly EMI (₹50L, 20 years) |

|---|---|

| 8.0% | ₹41,822 |

| 8.5% | ₹43,391 |

| 9.0% | ₹44,986 |

Even a 0.5% increase can raise your EMI noticeably.

Impact of Loan Tenure on EMI

| Tenure | Monthly EMI |

|---|---|

| 15 years | ₹49,240 |

| 20 years | ₹43,391 |

| 25 years | ₹40,276 |

Longer tenure reduces EMI but increases total interest cost.

Fixed vs Floating Interest Rate EMI

Fixed Interest Rate

-

EMI remains constant

-

Predictable payments

-

Slightly higher interest

Floating Interest Rate

-

EMI may change over time

-

Lower initial rates

-

Depends on market conditions

Most borrowers prefer floating interest rate home loan EMI calculator for long-term savings.

Home Loan EMI Calculator with Prepayment Option

Advanced calculators allow you to:

-

Check savings with partial prepayment

-

Reduce loan tenure

-

Compare EMI reduction vs tenure reduction

Salary-Based Home Loan EMI Planning

Banks usually allow EMI up to 40–50% of your monthly income.

Example:

Monthly income ₹80,000 → Safe EMI ₹32,000–₹40,000

Benefits of Using an Online Home Loan EMI Calculator

-

Accurate EMI calculation

-

Helps with loan eligibility planning

-

Improves financial decision-making

-

Useful for apartments, villas, and independent houses

-

Ideal for first-time home buyers

Frequently Asked Questions (FAQs)

1. What is the best tenure for a home loan?

A tenure of 20–25 years is ideal for most buyers, offering affordable EMIs.

2. Does increasing loan tenure reduce EMI?

Yes, EMI reduces, but the total interest paid increases.

3. Can my home loan EMI change?

Yes, if you choose a floating interest rate, EMI may increase or decrease.

4. Is home loan EMI calculated on reducing balance?

Yes, home loans follow the reducing balance method.

5. Can I calculate EMI for joint home loans?

Yes, EMI calculator work for both single and joint applicants.

6. Is using an EMI calculator free?

Yes, online home loan EMI calculators are completely free.

7. Can I use EMI calculator before loan approval?

Yes, it helps you plan before applying for a loan.

Conclusion

A Home Loan EMI Calculator with Interest Rate & Tenure is a must-use tool for anyone planning to buy a home. It helps you calculate EMIs accurately, compare loan options, and make informed financial decisions.

Before finalizing your home loan, always calculate your EMI, understand interest rate impact, and choose the right tenure to enjoy stress-free home ownership.

Subscribe to our newsletter

Get the latest financial tips and calculator updates delivered straight to your inbox.