How to Calculate Your Monthly EMI for Any Loan (Step-by-Step Guide)

Introduction

Whether you’re planning to buy a home, car, bike, or take a personal loan, one thing you must always check first is your Monthly EMI. Knowing your EMI makes it easy to plan your budget, control expenses, and choose the right loan.

But many people still ask,How do I calculate my EMI correctly?

In this simple and detailed guide, we explain what EMI is, how EMI is calculated, the exact EMI formula, examples, and an easy step-by-step method to calculate your monthly EMI for any loan.

Let’s get started!

What Is EMI?

EMI (Equated Monthly Installment) is the fixed amount you pay every month to repay your loan. Every EMI has two parts:

-

Principal Amount – The loan amount you borrowed

-

Interest Amount – The extra money charged by the bank

Your EMI remains fixed throughout the loan tenure (unless you choose floating rates).

Why Is EMI Calculation Important?

Before taking a loan, EMI calculation helps you understand:

-

Whether you can afford the loan

-

How much monthly burden you will have

-

Which bank gives lower EMI

-

How much total interest you will pay

-

Whether you should increase or decrease your loan tenure

Hence, using an EMI Calculator or understanding EMI calculation is extremely important.

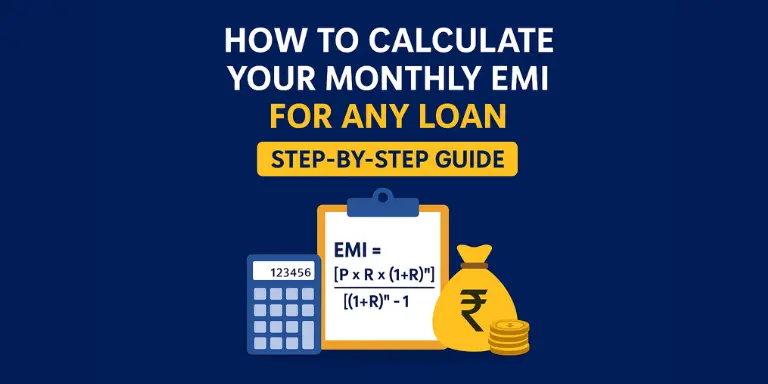

The EMI Calculation Formula (Most Important)

To calculate your EMI manually, banks use this universal formula:

EMI = [P × R × (1+R)ⁿ] / [(1+R)ⁿ – 1]

Where:

-

P = Loan Amount

-

R = Monthly Interest Rate (Annual Rate / 12 / 100)

-

n = Loan Tenure in Months

Don’t worry if it looks complicated — you will understand it easily with examples below.

Step-by-Step Guide to Calculate Monthly EMI for Any Loan

Step 1: Know Your Loan Amount (P)

This is the total money you borrow from the bank.

Example:

-

Home Loan: ₹30,00,000

-

Car Loan: ₹8,00,000

-

Personal Loan: ₹2,00,000

Step 2: Find Your Interest Rate (Annual Rate)

Every bank has a different interest rate.

Example:

-

8.5% Home Loan

-

10% Car Loan

-

12.5% Personal Loan

You will need the monthly interest rate for calculation:

Formula

Monthly Interest (R) = Annual Interest / 12 / 100

Example:

For 10% annual rate → 10 / 12 / 100 = 0.00833

Step 3: Choose Your Loan Tenure (in Months)

Convert years into months:

-

1 year = 12 months

-

5 years = 60 months

-

15 years = 180 months

Example:

Home Loan Tenure = 20 years = 240 months

Step 4: Apply the EMI Formula

Now use the formula:

EMI = [P × R × (1+R)ⁿ] / [(1+R)ⁿ – 1]

Example 1: Personal Loan EMI Calculation

Loan Amount (P): ₹2,00,000

Interest Rate: 12%

Tenure: 24 months

Step 1 → Convert interest rate

12% annual = 12/12/100 = 0.01

Step 2 → Apply formula

EMI = [2,00,000 × 0.01 × (1.01)²⁴] / [(1.01)²⁴ – 1]

Final EMI ≈ ₹9,414 per month

Example 2: Home Loan EMI Calculation

Loan Amount: ₹50,00,000

Interest Rate: 8.5%

Tenure: 20 years (240 months)

Interest per month = 8.5/12/100 = 0.00708

After applying formula →

EMI ≈ ₹43,391 per month

Example 3: Car Loan EMI Calculation

Loan Amount: ₹10,00,000

Interest Rate: 9%

Tenure: 5 years (60 months)

Monthly Rate = 9/12/100 = 0.0075

EMI ≈ ₹20,758 per month

Easiest Way: Use an Online EMI Calculator

Manual calculation is time-consuming. The simplest way is to use an online EMI Calculator like EMI Calculator VIP:

Just enter:

-

Loan Amount

-

Interest Rate

-

Tenure

It instantly shows:

-

Monthly EMI

-

Total Interest

-

Total Amount Payable

-

Amortization Table

This saves time and avoids calculation mistakes.

Factors That Affect Your EMI

1. Loan Amount

Higher loan = higher EMI.

2. Interest Rate

Higher rate = more EMI & more total interest.

3. Loan Tenure

Longer tenure → lower EMI but higher total interest.

Shorter tenure → higher EMI but lower interest.

4. Credit Score

Good score → low interest rate → low EMI.

5. Type of Loan

-

Home Loans → Low interest

-

Personal Loans → Higher interest

How to Reduce Your EMI?

Try these smart tips:

✔ Increase loan tenure

✔ Improve your credit score

✔ Make a higher down payment

✔ Choose a balance transfer

✔ Negotiate interest rate with bank

✔ Pay part-prepayment whenever possible

Amortization Table (What It Shows)

An amortization table shows:

-

EMI breakup → Principal + Interest

-

Remaining loan balance

-

Total interest paid over time

In the early years, most of the EMI goes toward interest, and later major part goes toward principal.

Benefits of Using an EMI Calculator

-

Saves time

-

Gives accurate EMI

-

Helps compare banks

-

Helps plan budget

-

Helps understand interest vs principal

-

Helps avoid loan traps

Using a proper EMI Calculator helps you become financially smart and avoid unnecessary stress.

Frequently Asked Questions (FAQs)

1. What is the formula to calculate EMI for any loan?

EMI = [P × R × (1+R)ⁿ] / [(1+R)ⁿ – 1], where P = loan amount, R = monthly interest rate, n = number of months.

2. Which is the best method to calculate EMI?

Using an online EMI calculator is the easiest and most accurate method.

3. Why does EMI change for floating interest loans?

Floating interest rates vary based on RBI policy, so EMI may increase or decrease.

4. Is shorter or longer loan tenure better?

Short tenure → high EMI but low interest.

Long tenure → low EMI but high interest.

5. Can I reduce my EMI after taking the loan?

Yes. You can increase tenure, do a balance transfer, or request bank for rate reduction.

Conclusion

Calculating your monthly EMI is not difficult once you know the formula and steps. But the easiest way to get accurate results is by using an online EMI Calculator. It helps you compare loans, plan your budget, save interest, and take smarter financial decisions.

Subscribe to our newsletter

Get the latest financial tips and calculator updates delivered straight to your inbox.